If you’ve been following the news, you may have heard that the economy is slowing down. While it’s not the end of the world, watching inflation rise and stock market prices dive can be scary.

In an effort to provide some relief to this inflationary pain, some states will be sending out inflation-relief checks of varying amounts later this year—these range from a $75-per-person tax rebate in Idaho to direct payments of up to $1,050 per household in California. While there’s no way to predict exactly what will happen in the coming year or next few years, you can take steps now to strategically use this money and stay ahead of the game, no matter what a recession may bring.

We’ve come up with a list of the 3 recession-proof things you can do with your relief check to help you get through this time and come out stronger on the other side.

Build An Emergency Fund

Inflationary prices mean that you probably have less disposable income than usual. It is now more important than ever to make sure you have an emergency fund in place.

Experts recommend that you set aside 6 months of living expenses to have a true emergency fund. It’s best to use a high-yield savings account like PrizePool to store your emergency fund so that it will still earn high interest and continue to grow, all while remaining completely safe and secure. Keeping your emergency fund separate from your normal spending account helps ensure you’re less tempted to spend it. ?

If you do have an unexpected expense or lose your income unexpectedly due to a layoff or injury, having your fund intact will help you weather the storm until you find new work or get back on your feet again!

Eliminate High-Interest Debt

With purchase power decreasing, the last thing you want to have is compounding debt.

Continually rising prices make it easier to rack up unwanted debt and even more difficult to pay it off. While no set number determines ‘high-interest’, you most likely will want to prioritize paying off your credit card debt that can carry an interest rate of 20%+ as credit card debt is typically compounded daily and you’d want to avoid any more interest charges on top of what you already owe.

Knocking out this debt early on will lessen your payments moving forward as well as provide some peace of mind as we continue into an inflationary market ?

Invest for the Long Term

This recessionary pain will not last forever, so investing in your future is still a wise choice.

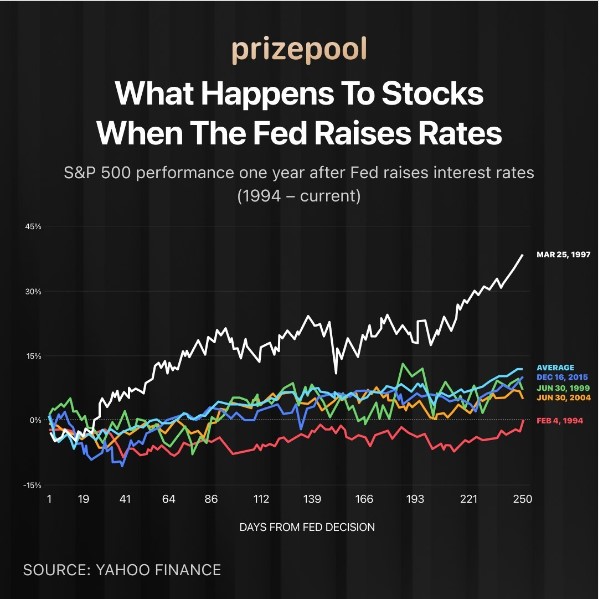

If you’re in a position where long-term investing fits your financial strategy, you can use the extra cash to invest for the future—even if that means losing money in the short term. In fact, if you buy when the market’s down, you might thank yourself later. While you may not reap huge rewards in the near future, the market has historically always recovered from major shocks.

If retirement is not in your near future, consider a low-risk investment such as the S&P 500, or another similar index fund, is a step that could set you up for financial success and wealth for years to come.